Secured today, unsecured tomorrow: SBR essentials for secured creditors

There are some things you should know if you are a secured creditor with a claim against a company going through the Small Business Restructuring (SBR) process.

A key thing to note is that it is not an opt in/out process. What debts are included in an SBR are set out by law. Even if you take no action, the SBR process could affect your rights to enforce your debt.

Only the estimated shortfall of your debt is included.

ALLPAAP creditors

If you hold security over all of the assets of the company (an ALLPAAP security), you are required to estimate the value of all the company’s assets should they be sold. This could be a complicated process depending on the assets and business of the company. There is also no guidance on who has the last say on the valuation should there be a disagreement.

What happens if the assets of the company are worth less than your debt? The estimated shortfall is included as a claim in the SBR whether you want it to be or not.

This causes several issues, most notably, the company is then considered discharged from any unsecured portion (i.e. your debt less the estimated value of the security) upon the fulfillment of the plan's obligations. This discharge occurs regardless of the secured creditor's participation in the voting process.

This means that if later, the company defaults and sells the assets for more than you had estimated during the SBR, you’re not entitled to the amount above the estimated value of the security.

Second ranking ALLPAAP creditor

If you are a second-ranking ALLPAAP creditor and the value of the assets is not sufficient to pay out the first ranking secured creditor, the entire amount of your debt is included in the SBR process. You then, in effect, become an ordinary unsecured creditor entitled to receive the same cents in the dollar dividend as other unsecured creditors. You will have no rights against the company (in relation to your debt) after the SBR process. This is a situation we had arise recently. This situation can raise arguments in which the second ranking secured creditor estimates the asset value to be much higher than the first ranking secured creditor.

PMSI security over a specific asset

The same rules as set out above will apply to you. If you have security over a specific asset, say a car for example, you must also estimate the value of the car and claim for shortfall of your debt. There is no option to not be included in the SBR process unless the value of the security is greater than your debt.

No estimated shortfall

If there is no shortfall, then you are not an affected creditor, and you have no claim in the SBR process. This is likely an ideal outcome as it is then business-as-usual, and the company will continue to pay the debt in the ordinary course. In fact, the company should be in a better financial position after the SBR process to continue servicing the debt.

Secured creditor can decide to be bound

If the restructuring plan affects the secured creditors rights and the secured creditor accepts the plan, the secured creditor’s rights will be varied as set out in the restructuring plan. This allows flexibility for the secured creditor to work with the company to achieve mutually beneficial goals.

Personal Guarantees

A small business restructuring does not affect a secured creditor’s rights against a guarantor, other than a short moratorium period. Where some of debt becomes unsecured for reasons set out above, a guarantee will allow recovery of that compromised portion.

For example: if the director had personally guaranteed a debt to the secured creditor, there was a shortfall, and a restructuring plan was accepted, the secured creditor can still pursue the director for the debt, including the shortfall that was included in the restructuring.

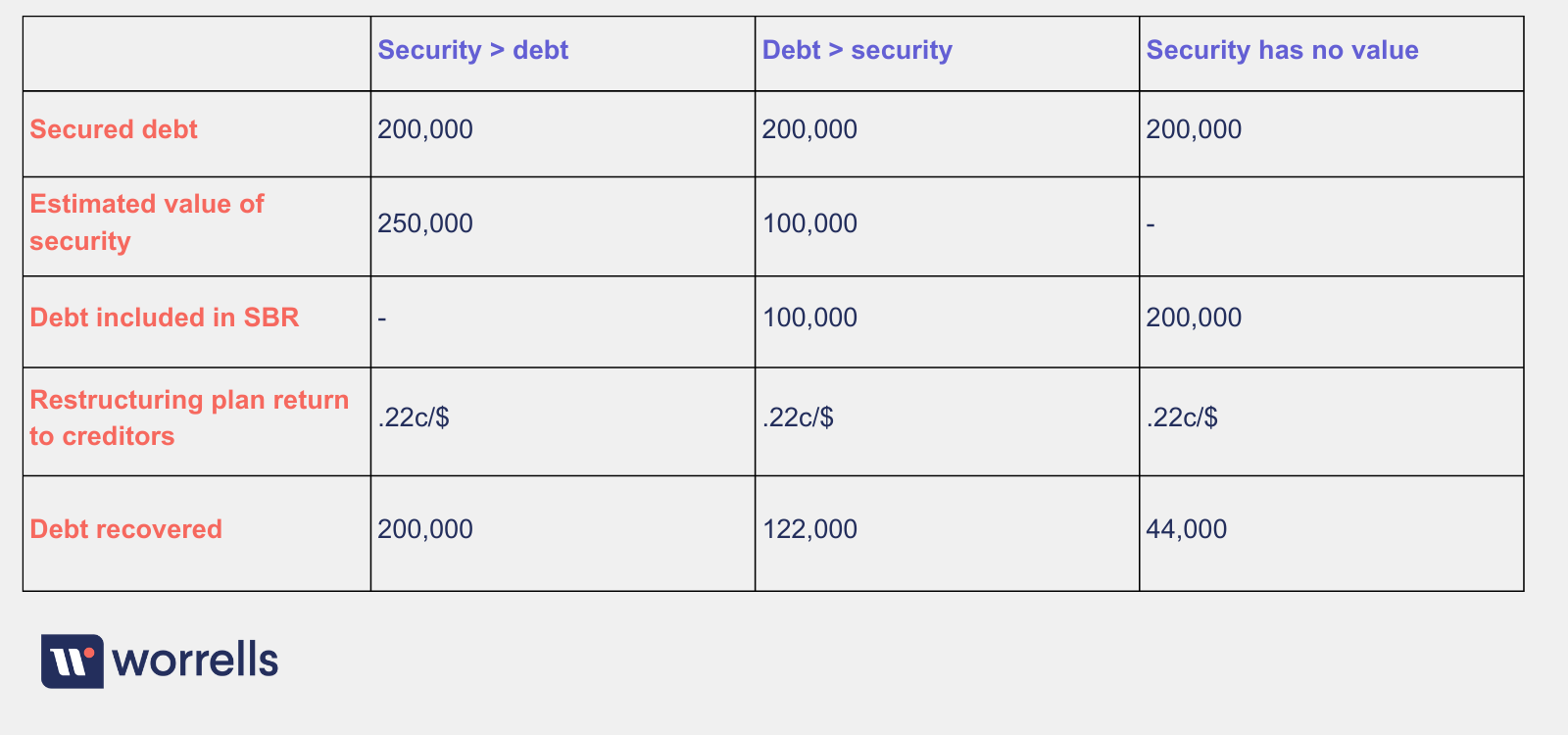

Example

Below is simplified example of a secured creditor and how their debt is affected in the different scenarios (assuming an interest free debt).

Takeaways

For secured creditors, it is essential to understand that your involvement is mandated by law, regardless of your intent to participate. The SBR process can impact your rights and claims, and it is vital to clarify your position. It's recommended to proactively contact the Restructuring Practitioner to ascertain the extent of your involvement and protect your interests.

.png?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=800&h=480&q=25&blur=5&sat=-100)

.png?auto=format,compress&cs=tinysrgb&fit=crop&crop=focalpoint&fp-x=0.50&fp-y=0.50&fp-y=0.1&w=800&h=480&q=25&blur=5&sat=-100)